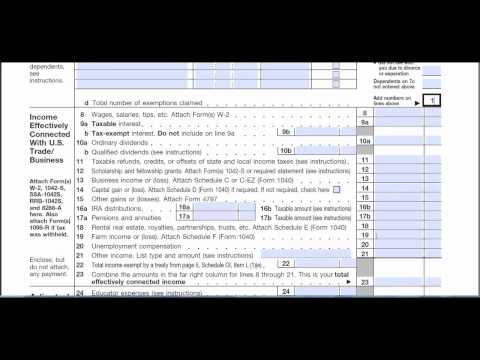

We're going to fill out the 1040 NR non-resident alien income tax return. Let's take it from the top. Our taxpayer's first name, last name, and ID number, which is probably an ITIN number as opposed to a social security number. Next, we need his address, city, postal code, country, and filing status. In this case, he is another single non-resident alien. Moving on to exemptions, we will check off that we're just claiming himself. We will put a 1 on the right and bring that down. His total number of exemptions is 1. Let's take his wages from his W-2 form and put that on line 8. Since he doesn't have any other kinds of income, we're going to bring that same number down to line 23. Next, we will check if he has any adjustments, but since he doesn't have any, his adjusted gross income on line 36 will be the same. Now, let's go to page 2 and bring that number up to line 37. It's difficult for a non-resident alien to get itemized deductions, and since our taxpayer doesn't have any, we're going to take that gross income number onto line 39. We will put his exemptions on line 40 and subtract the one from the other to get his taxable income on line 41. With his taxable income calculated, we can now move on to calculating his tax. It comes out to be $363, which we will bring down to line 44 and line 52. Since he doesn't have any other kinds of taxes, we will bring that number down to line 59. Now, let's look at what he paid in on his W-2 form. We will put the withholdings on line 60 and total up all the amounts he's paid on line 68. Finally,...

Award-winning PDF software

1042 instructions 2025 Form: What You Should Know

Transportation and Communication Utility Tax Return. 04/18/2021 — Present. Form R-5201v. R-5210v. Instructions for Hazardous Waste Transportation and Communication Utility Tax Return. 04/25/2021 — Present. Form R-5201w. Instructions for Hazardous Waste Transportation and Communication Utility Tax Return. 08/11/2021 — Present. Form R-5201n. R-5210n. Instructions for Hazardous Waste Transportation and Communication Utility Tax Return. 08/25/2020 — Presented. Form R-5201 m. R-5210 m. Instructions for Hazardous Waste Transportation and Communication Utility Tax Return. 09/08/2020. PRESENT. Instructions for the Hazardous Waste Business Registration Form. 12/09/2019. . PRESENT. Instructions for Information and Notice on Form R-5201i. (for persons who own an individual residence in a foreign country which has a property tax.) Instructions for Information and Notice on Form R-5201i. (for persons who own an individual residence in a foreign country which does not have a property tax.) Instructions for Information and Notice on Form R-5201i. (for persons who use services in a foreign country to perform services as defined in Article 2 of the Income and Business Tax Convention.) Instructions for Information and Notice for Foreign Corporations (F-Corporations) and Foreign Trusts (E-Trusts). 05/21/2021 — Presented. Form R-5201V. R-5210V. Instructions for a Foreign Corporation (F-Corporation) (Form R-5201) (Form R-5210) or a Foreign Trust (E-Trust) (Form R-5210). Instructions for Information and Notice for Foreign Businesses (F-Bodies). 12/16/2018. Presented. Form R-5201E. R-5210E. Instructions for a Foreign Business (F-Body) (Form R-5201E) (Form R-5210E). Instructions for Information and Notice for Foreign Businesses (F-Bodies) and Foreign Corporations (F-Corporations). 08/20/2018. PRESENT.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1042-S, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1042-S online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1042-S by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1042-S from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 1042 instructions 2025